Offer bike leasing now with Lease a Bike - powered by Volkswagen Financial Services AG - and benefit from many advantages.

We are at your side with our first-class customer service during implementation and for all questions relating to e-bikes and bike leasing. From a personalized online portal to personal support on site.

We offer you a range of services free of charge: from a sample leasing contract to personal advice on the company guidelines for your e-bike and bike leasing offer.

We support you as an employer in the successful implementation of e-bike and bicycle leasing. Our service includes kick-off events, webinars and marketing support in the form of flyers and much more.

Offer e-bike and bike leasing, enable dream bikes and retain employees in your company.

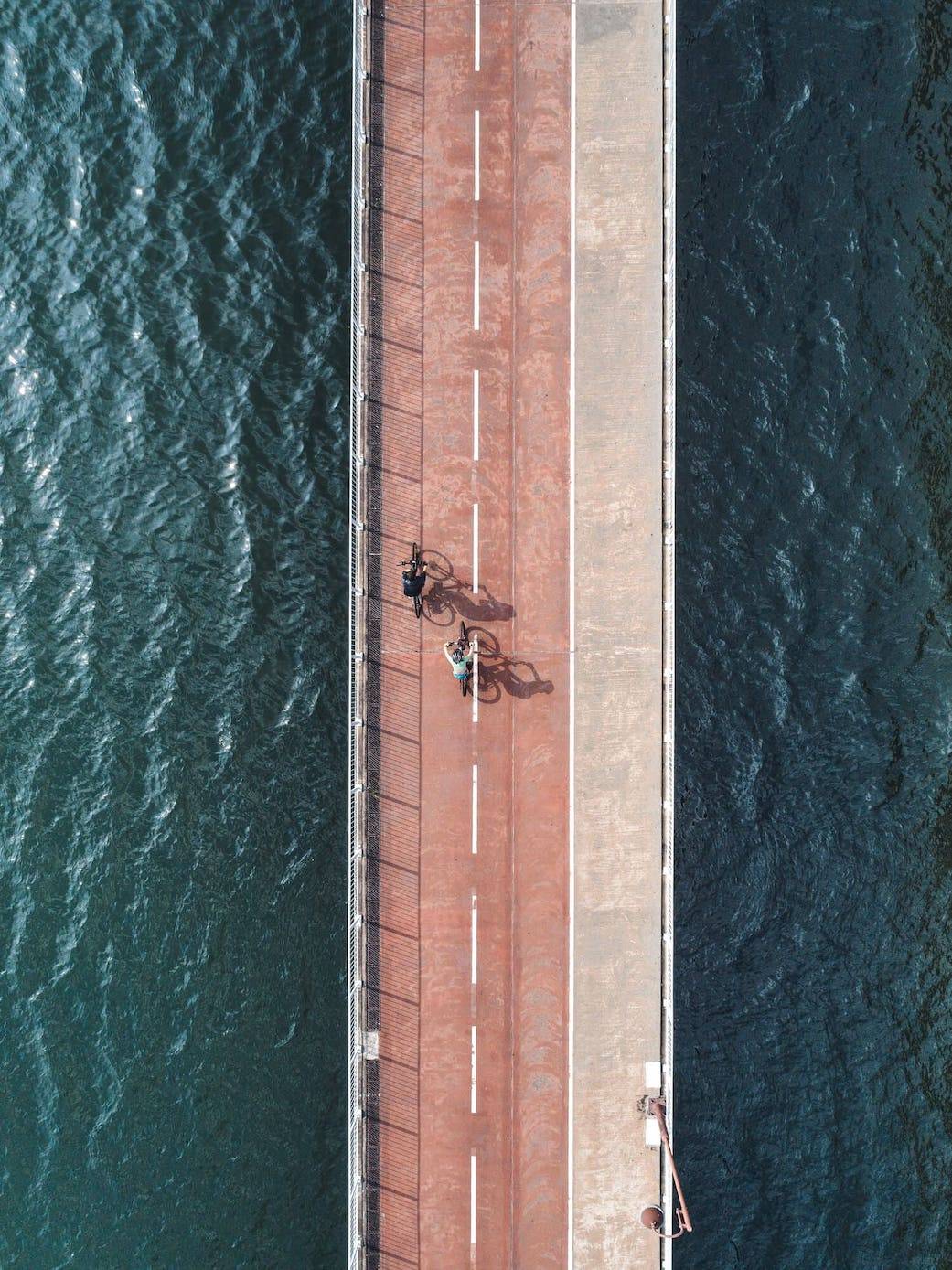

Cycling to work not only increases productivity, but thanks to e-bikes and bike leasing, you also make a contribution to climate protection. Calculate your savings in the CO₂ calculator.

E-bike and bike leasing is very popular with employees, keeps them fit and can reduce sick days.

Get all the information you need about e-bike and bike leasing for employers quickly and easily by email.

Offer the most popular employee benefit now. E-bike and bicycle leasing sounds complicated? But it's not! We explain the process to you as an employer in just 60 seconds. For more information, you can download our information package.

As an employer you would like to offer bike leasing as an employee benefit? No problem! With Lease a Bike, your employees can quickly and easily lease their dream bike. Thanks to wage conversion, the wish wheel is paid monthly via the gross salary and your employees save on social security contributions and taxes.

And that’s how you register as an employer for bike leasing with Lease a Bike.

Fill out the registration form for our bike leasing concept in just 5 minutes. We will then carry out a credit check of your company. After successful examination, you will be granted access to our online portal.

You define the company policies in the online portal. How much can the purchase price of the bike be? How many bikes can be leased per employee? You will then share your individual registration link with your employees. The registration for the bike leasing of your company is completely digital.

Every employee registration is checked by you and approved for bike leasing. This is done with just one click and your employee automatically receives an individual order code for the service bike order at the local bicycle specialist shop. The rest is done automatically via the digital portal.

A real-time export from our digital portal provides you with all the necessary information you need for the internal handling of bike leasing in your company and for your payroll.

Get started with bike leasing as an employer in just four steps thanks to our digital portal!

Minimal effort is also guaranteed following your registration: All it takes is one click to activate the employee's bike order in the Lease a Bike portal. It is also only necessary to enter the data for the salary conversion once at the start of the contract. In addition, incidents such as long-term illness or parental leave can also be reported via the Lease a Bike portal with just a few clicks.

In the event of theft or damage, you as the employer have no work to do, as the employees clarify the matter completely themselves with our specialist retail partners and Lease a Bike. In addition, you also have no workload at the regular end of the contract, as Lease a Bike coordinates the further procedure exclusively with the employees. Only in exceptional cases, if the employee cannot be reached by phone or email despite several attempts, will you as the employer be called in to help.

This way, you benefit from minimum effort and maximum benefit!

In principle, all permanent employees can lease company bikes. However, who is allowed to lease a company bike is determined by you as the employer and can therefore be limited to certain employment relationships. Bike leasing for mini-jobs, for example, is usually not possible.

The term of contracts for company bikes is generally 36 months.

You can offer company bicycle leasing in your company as an employee benefit. With Lease a Bike you enable your employees to quickly and easily lease their dream bike. Thanks to wage conversion, the wish wheel is paid monthly via the gross salary and your employees save on social security contributions and taxes. As an employer, you benefit from stronger employee loyalty and healthier employees, for example. You also contribute to sustainable mobility. You can also find more information here.

Since 2012, the company car principle has also been applied to bicycles and e-bikes. Company bike leasing increases productivity, promotes health and has been proven to reduce employee sick days. As an employer, you can implement the offer free of charge and risk.

The advantageous salary conversion and the comprehensive all-round protection make the concept of the service wheel interesting for both employers and employees, thereby enhancing the company's image. Company bicycle leasing is now the most popular benefit for employees. Other benefits include reduced turnover, increased employee satisfaction and a positive contribution to the company's environmental footprint.

With Lease a Bike you also benefit from an extra portion of customer service. We are here to help you with the implementation and all questions related to e-bike and bicycle leasing with our first-class customer service. From a personalised online portal to personal on-site support. Find out more about the benefits for your company here.

When the salary is converted, the employee receives part of the contractually agreed salary not in cash, but in kind for the period of the secondment of the service.

In other words, an amendment is made by means of an additional agreement to the employment contract, in which the future salary of the employee is reduced by a fixed amount (conversion rate) for the duration of the loan. This then results in the tax and contribution advantage for the employees. In addition, in most cases the monetary benefit is taxed. This is added to the gross monthly salary. What exactly does that mean?

Gross monthly salary

+ taxation of imputed income

- Conversion rate

- All-round protection costs

= new gross monthly salary

- Taxes

- Taxation of imputed income

= net monthly salary

If you now compare the net monthly salary without the company bike with the net monthly salary with the company bike, you get the monthly costs for the company bike leasing.

Below you will find some explanations of terms.

Conversion rate:

The conversion rate is the sum of the leasing rate and the cost of the selected all-round protection package, less any cost coverage by the employer The gross monthly salary is reduced by this conversion rate.

Taxation of the monetary advantage:

Depending on the form of provision by you as the employer, the use of the service bike is subject to taxation of the monetary benefit. In the event that a service bicycle is made available for unrestricted private use in the context of a salary conversion, the cash benefit must be taxed. The cash benefit of the company bicycle leasing is calculated at a flat rate of 1% of a quarter of the gross list price (GBP) rounded to the full 100€, added to the taxable income and taxed with it. Colloquially speaking, there is also a 0. 25% tax. The amount for the cash benefit can be found in the calculation overview on the calculator page.

The implementation of company wheel leasing is cost-neutral. As an employer, you can make use of our payment protection in the event of continued salary payments being discontinued. This happens, for example, if employees are ill for longer than 42 days and receive sick pay or go on parental leave. Lease a Bike takes over the leasing installments for a maximum period of 12 months, but only if the leasing contract has already been running for 6 months. In any case, we will always work with you to find the best solution - right up to the individual, cost-neutral return of the company bike for you as the employer.

As a rule, employees lease via deferred compensation. A small portion of the gross salary is withheld as a leasing installment. This "remuneration in kind" must be taxed monthly at 0.25% of the gross list price. This does not incur any costs for the company.

As an employer, you can reduce the monthly conversion rate with a voluntary subsidy, for example through the fair amount. When the fair amount is applied, employer-side savings in social insurance that arise from deferred compensation are passed on to the employees, so that their savings from leasing are even higher than with classic deferred compensation.

You can also pass the company bike on to employees as a salary bonus, in which case you pay the monthly leasing installments. In this case, employees do not have to pay tax on the non-cash benefit for private use.

If you do not wish to purchase the bike, we can arrange for it to be collected from the user or the company.

You can make use of our installment loss protection in the event of continued salary payments being discontinued.

This happens, for example, if employees are ill for longer than 42 days and receive sick pay or go on parental leave. Lease a Bike takes over the leasing installments for a maximum period of 12 months, provided the leasing contract has already been running for 6 months.

In any case, we will always work with you to find the best solution - right up to the individual, cost-neutral return of the company bike for you as the employer, unless one of the following options is possible.

These can be:

Company managers can submit a request for the above options via the Lease a Bike portal.

If one of your employees leaves the company and has a Lease a Bike company bike, we offer you the following options.

You can offer the remaining company bike to another employee for the remainder of the leasing term. As the employer, you take all the necessary internal measures (e.g. supplementary agreements to the employment contract, handover of the company bike, etc.) and ensure that the new user is registered in the Lease a Bike portal. Lease a Bike takes care of the name transfer. The transfer is free of charge.

The employee or you as the employer have the option of buying the leased asset out of the leasing contract. Ownership of the leased asset is transferred after purchase. The employee also has the option of financing the redemption amount via the FINANCE A BIKE product. This requires online banking access and a valid identity card with German citizenship.

Subject to a credit check, the leasing object is contractually transferred to the new company. The new employer now has the option of converting the existing leasing contract into a salary conversion and continuing to provide the employee with the leased object as a company bike. The prerequisite for this is a declaration of consent from the new company and registration with Lease a Bike. The transfer is free of charge.

Company managers can submit a request for the above options via the Lease a Bike portal.

Employees can choose between one of three packages - Basic, Premium or All-inclusive - with different budget limits depending on the selected bike and usage. The budget included in the package can be used for necessary wear and tear repairs and for an annual inspection*. Tyre damage is also covered by the individual annual wear and tear budget.

The budget per package is:

*Note: The costs of the annual inspection are capped. The costs of the initial inspection are only billable up to a gross amount of €41.65 via the selected service package. The costs of subsequent annual inspections are only billable up to a gross amount of €83.30 via the selected service package. Any additional inspection costs are to be borne by the lessee or user.

Every Lease a Bike all-round protection package includes theft & damage protection, as well as a free Europe-wide mobility guarantee and a service package with an annual budget for wear and tear repairs and inspections.

Theft & damage protection

Our theft & damage protection covers all sudden and unforeseeable damage or destruction to the company bike, e.g. due to

There is no deductible!

Service package

Employees can choose between one of three packages - Basic, Premium or All-inclusive - with different budget limits depending on the selected bike and usage. The budget included in the package can be used for necessary wear and tear repairs and for an annual inspection*. Tyre damage is also covered by the individual annual wear and tear budget.

The budget per package is:

*Note: The costs of the annual inspection are capped. The costs of the initial inspection are only billable up to a gross amount of €41.65 via the selected service package. The costs of subsequent annual inspections are only billable up to a gross amount of €83.30 via the selected service package. Any additional inspection costs are to be borne by the lessee or user.

Free Europe-wide mobility guarantee including 24/7 roadside assistance

In the event of a claim, we provide the following services to maintain mobility the following services:

If you would like to take advantage of the mobility guarantee, please call 0049 4471 967 3113.

*from a distance of 10km from your permanent residence

Our theft & damage cover includes all sudden and unforeseeable damage or destruction to the leased object, e.g. due to:

The company bike and company car can also be used at the same time. The 1% method then applies to both the company bike and the car.

In contrast to the company car, employees do not have to pay tax of 0.03 percent per kilometer for the journey to work.

Electric bicycles with a motor that provides assistance at more than 25 km per hour are classified as motor vehicles under traffic law and the non-cash benefit is assessed in the same way as for a company car.

Note: For company bicycles, the assessment basis for the taxable non-cash benefit is quartered and rounded down to the nearest hundred. This corresponds to 0.25% taxation.

The commuting allowance for journeys between home and work is generally to be granted at € 0.30/km regardless of the means of transportation (Section 9 (1) No. 4 EstG).

The leasing installments for company bicycles are considered business expenses for business management purposes. This means that companies entitled to deduct input tax can deduct the VAT included from the conversion rate. The employees then convert the net leasing installments, resulting in even greater savings.

Companies that are not entitled to deduct input tax, on the other hand, convert the leasing installment including VAT, so that the savings for the employees are somewhat lower.

Service leasing is sometimes associated with potential disadvantages, but a closer look reveals that many of these concerns can be easily refuted. If you look at the advantages, they often clearly outweigh the potential disadvantages. The most common points of criticism are used to show why company leasing is not only an economically sensible solution, but also a convenient and sustainable one for employees and employers.

A company health day is an excellent opportunity to raise employees' awareness of their own health and well-being. This day aims to promote healthy lifestyle habits and motivate employees to actively engage with topics such as physical fitness, mental health, nutrition and prevention. Through targeted offers, they can better assess health risks and take preventative measures to improve their own health in the long term.

In recent years, bicycle leasing has established itself as an attractive offer for employers and employees. It combines ecological sustainability with health promotion and offers financial benefits for both companies and their employees. But how exactly does bike leasing influence employee motivation?